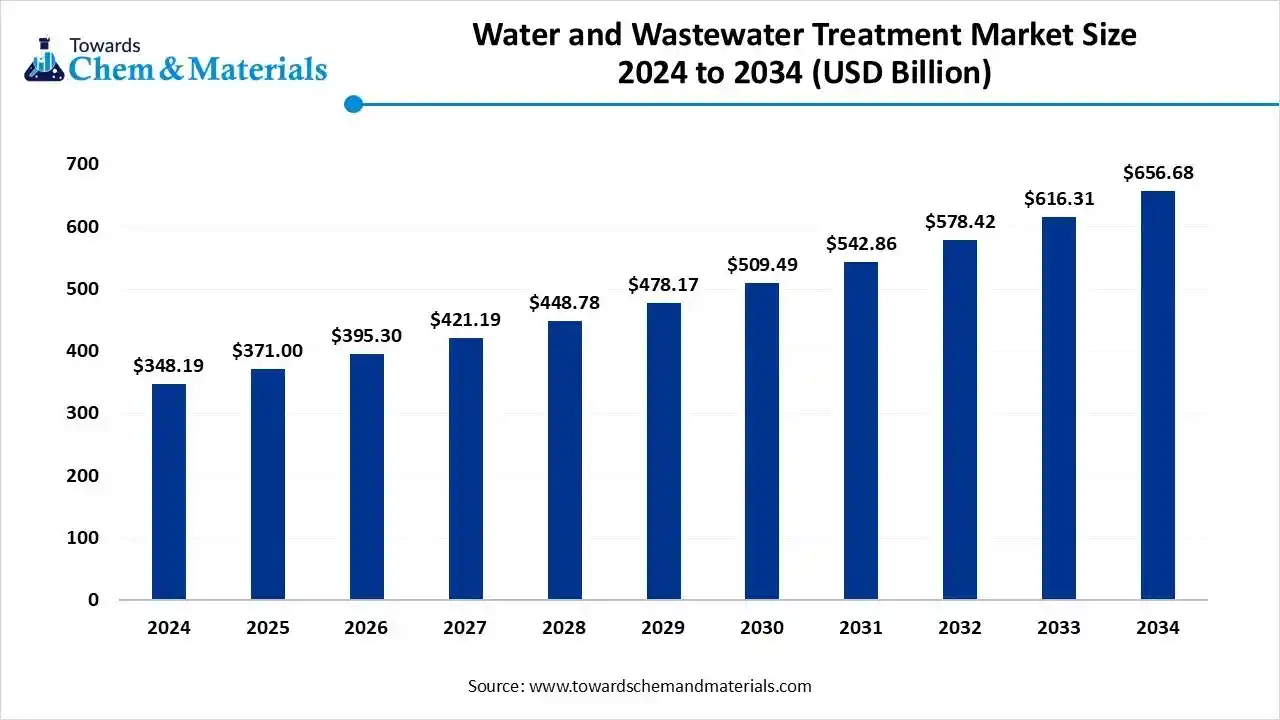

Water & Wastewater Treatment Market Size to Worth USD 656.68 Bn by 2034

According to Towards Chemical and Materials, the global water & wastewater treatment market size is calculated at USD 371 billion in 2025 and is expected to be worth around USD 656.68 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.55% over the forecast period 2025 to 2034.

Ottawa, Oct. 07, 2025 (GLOBE NEWSWIRE) -- The global water & wastewater treatment market size was valued at USD 348.19 billion in 2024 and is anticipated to reach around USD 656.68 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.55% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5881

Water & Wastewater Treatment Overview

The Rising global demand for clean drinking water and stringent environmental regulations are driving the growth of the market. the water & wastewater treatment market is evolving rapidly, propelled by intensifying concerns over freshwater scarcity, urbanization, and stricter regulatory frameworks mandating cleaner effluent discharge. Public and private stakeholders are investing heavily in infrastructure upgrades, advanced treatment technologies, and water reuse systems in response to rising demand for safe drinking water and industrial process water. Concurrently, growth in industrialization specially across emerging economies is driving increased wastewater generation, requiring more robust treatment solutions. Innovations in membrane filtration, biological systems, advanced oxidation, and digital monitoring are gaining traction to enhance efficiency, reduce energy consumption, and minimize environmental impact. As regions enforce more stringent water quality standards and adopt circular economy strategies, the market is increasingly focused on holistic, sustainable waste resource management across municipal, agricultural, and industrial domains.

Water & Wastewater Treatment Market Report Highlights

- The Asia Pacific water & wastewater treatment market size was estimated at USD 118.38 billion in 2024 and is projected to reach USD 223.67 billion by 2034, growing at a CAGR of 6.57% from 2025 to 2034.

- By region, Asia Pacific dominated the water & wastewater treatment market with approximately 34% share in 2024.

- By end-user industry, the municipal segment held approximately a 42% share in the market in 2024.

- By treatment objective, the wastewater treatment segment held approximately a 38% share in the water & wastewater treatment market in 2024.

- By treatment technology, the biological processes segment held approximately a 33% share in the market in 2024.

- By product, the pumps & motors segment held approximately a 28% share in the market in 2024.

- By deployment, the public/municipal segment held approximately a 50% share in the market in 2024.

- By capacity, the large segment held approximately a 36% share in the market in 2024.

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/price/5881

Water & Wastewater Treatment Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 395.35 billion |

| Revenue forecast in 2034 | USD 656.68 billion |

| Growth rate | CAGR of 6.55% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2021 - 2024 |

| Forecast period | 2025 - 2034 |

| Segments covered | By End-User Industry, By Treatment Objective, By Treatment Technology / Method, By Product / Equipment, By Deployment / Ownership Model, By Capacity / Plant Size, By Region |

| Key companies profiled | Veolia, SUEZ, Xylem Inc., Danaher Corporation, Evoqua Water Technologies, Ecolab (Nalco Water), Pentair PLC, Grundfos, Kurita Water Industries, IDE Technologies, Doosan Heavy Industries & Construction, Thermax Ltd., Mitsubishi Heavy Industries, Fluence Corporation, Aquatech International, Ovivo Inc., Alfa Laval, KSB SE & Co. KGaA, Sulzer Ltd., Hach Company |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

What Are the Major Trends in The Water & Wastewater Treatment Market?

- Growing focus on water use and recycling to combat water scarcity.

- Rising adoption of membrane-based technologies (e.g. ultrafiltration, nanofilteration, reverse osmosis) for higher treatment efficiency.

- Integration of digitalization and smart monitoring (IoT, sensors, analytics) for operational optimization.

- Increasing regulatory pressure on removing micro pollutants, nutrients, and emerging contaminants.

- Shift toward decentralization treatment systems and modular designs to serve remote or small communities.

What Processes Take Place in Wastewater Treatment Plants?

The water entering WWTPs undergoes a series of physical, chemical and biological processes to remove the pollutants it contains. These processes are usually divided into four stages known as preliminary, primary, secondary and tertiary treatments.

In addition, WWTPs also carry out other processes associated with the by-products obtained in the different treatments. Some of these processes, such as the treatment and management of sludge, are significant because they are complex to manage and are of great interest.

1. Preliminary treatment

Preliminary or pretreatment, is the first stage of wastewater treatment and is used to prepare water for purification during the following phases. Thus, it consists of removing objects that could damage the plant or the equipment that will be used during the purification process.

First, roughing filtration is usually carried out. This process separates out the large and medium-sized solid waste using different thickness screens and sieves. Subsequently, grease and sand particles are removed using desanders and degreasers.

2. Primary treatment

The objective of this stage is to remove part of the suspended solids. To this end, water is retained for one to two hours in decanter centrifuges where gravity helps to separate these particles. Other benefits of this process include flow homogenization and the removal of organic matter linked to the suspended solids.

During this process, chemicals such as coagulants and flocculants can also be added to improve the sedimentation of solids and remove phosphorus. In some cases, bases and acidic agents are used to neutralize the water’s pH.

3. Secondary treatment

This process is designed to remove organic matter from the water, as well as nutrients such as nitrogen and phosphorus.

This secondary treatment, which is mainly biological, generally utilizes bacteria and microorganisms to degrade and eliminate the organic matter and the different nutrients contained in the water. The most widespread treatment is activated sludge, where the water to be treated is left in a tank for several days under varying oxygen conditions (aerobic, anoxic and anaerobic) depending on the required removal requirements. Here, the different types of bacteria that live in the tank or reactor feed on the organic matter and the nutrients contained in the water, removing them from the water and taking them into their organisms.

A second or secondary settling process is usual after the biological process. Here, the bacteria that have grown in the previous process precipitate to the lower part of the settling tank, generating a mixture of water and solids, which is called biological sludge. This mixture is extracted or flushed out through the lower part of the decanter and the purified water flows out through the upper part without most of the bacteria and solids, giving rise to clarified water.

It is common in wastewater treatment plants for water treatment to end at this point, when the treated water meets the defined discharge requirements and there are no additional water quality requirements for reuse or further use.

4. Tertiary treatment

During tertiary or chemical treatment, the aim is to increase the final quality of the water so that it can be returned to the environment (sea, rivers, lakes and other hydrographic basins) and, in some cases, used for human activity. To achieve this, a series of processes are carried out to eliminate pathogenic agents, such as fecal bacteria.

The techniques used include filtration with sand beds or other materials, and disinfection, either using chlorine (usually sodium hypochlorite) or UV light, to reduce the amount of microscopic living organisms that have been generated in the previous stages.

Types of Wastewater Treatment Plants

There are several different types of wastewater treatment plants, each using different methods to treat wastewater. The most common types of wastewater treatment plants include:

- Conventional activated sludge plants: These plants use aeration tanks to introduce oxygen into the wastewater, which helps to support the growth of bacteria that can break down organic matter.

- Trickling filter plants: These plants use a bed of rocks or other media to support the growth of bacteria that can break down organic matter.

- Membrane bioreactor plants: These plants use a combination of biological treatment and filtration to produce high-quality water.

- Sequencing batch reactors: These plants use a series of tanks to treat wastewater in batches, allowing greater control over the treatment process.

Benefits of Wastewater Treatment

Wastewater treatment offers a range of benefits to the environment and public health. By removing contaminants from wastewater, we can reduce the risk of water pollution and the spread of waterborne diseases. This, in turn, helps to protect our natural resources and preserve the delicate ecosystems that depend on clean water.

In addition, wastewater treatment can produce valuable resources, such as biosolids and methane gas. Biosolids are nutrient-rich organic materials that can be used as fertilizer, while methane gas can be used to generate electricity.

Wastewater treatment can also help to reduce water scarcity by producing high-quality water that can be reused for other purposes, such as irrigation or industrial processes. This can help to conserve freshwater resources and reduce the strain on existing water supplies.

Water & Wastewater Treatment Market Growth Factors

Is Climate Change Forcing Smarter Water Management?

Rising droughts and erratic rainfall patterns are pushing cities and industries worldwide to rethink how they source, treat and reuse water. Governments and utilities are turning to treatment technologies not only for purification but also for water recovery and circular use. This shift is no longer optional it’s becoming a survival strategy for agriculture, manufacturing, and urban infrastructure and urban infrastructure. As resilience planning becomes mainstream, investment In treatment and reuse facilities accelerates.

Can Pollution Crackdown Spark Innovation In Wastewater Treatment?

Stricter discharge rules targeting micro plastics, pharmaceuticals, and industrial toxins are compelling operators to upgrade outdated systems. Instead of relying on basic filtration, facilities are adopting advanced oxidation, membrane separation, and biological recovery technologies to meet newer compliance demands. What began as a regulatory burden is quickly becoming a catalyst for modernization and efficiency. Cleaner effluent is now tied to corporate responsibility and public image, making treatment innovation a competitive advantage.

Market Opportunity

What Water Treatment Opportunity Comes from Smart Technology?

The water & wastewater treatment market sees promising growth from the integration of AI and IoT technologies that enable smart monitoring and management of water systems. These innovations help in predicting system failures, optimizing chemical usage, and ensuring regulatory compliance through real time data analytics. Such digital transformation reduces operational costs and enhances efficiency in water purification plants. The ability to automate complex process and provide early warnings is encouraging industries and municipalities to adopt these intelligent systems. This shift towards smart water management presents extensive opportunities for innovation and market expansion.

How Decentralized Treatment Systems Improve Water Reuse?

Decentralized wastewater treatment is gaining momentum as a flexible, cost-effective solution for treating wastewater close to the source. This approach reduces the load on large centralized plants and promotes efficient water reuse in residential, industrial, and rural settings. It addresses infrastructure challenges in remote or rapidly urbanizing areas by providing localized solutions that require lower installation and maintenance costs. Decentralized systems also support sustainability goals by minimizing water wastage and enabling quicker turnaround of treated water. As demand for sustainable water management rises, decentralized treatment offers a scalable opportunity goals by sustainable water management rises, decentralized treatment offers a scalable opportunity for growing both municipal and industrial applications.

Limitations In The Water & Wastewater Treatment Market

- High installation and maintenance costs often make advanced treatment systems difficult to adopt for small municipalities and rural areas.

- Lack of skilled professionals to operate and manage complex treatment technologies limits efficiency and scalability.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5881

Water And Wastewater Treatment Market Segmentation Insights

End Use Industry Insights

Why Is Municipal Segment Dominating in Water & Wastewater Treatment Market?

The municipal segment dominated the market in 2024. Municipalities are focusing on providing safe drinking water and efficient wastewater management to growing urban populations. Investment in advanced purification, sewage treatment, and water recycling solutions are helping cities meet stricter environmental regulations. Adoption of smart monitoring systems ensures consistent water quality and operational efficiency. As a result, municipal applications continue to dominate the demand for water and wastewater treatment solutions globally.

The industrial segment is projected to experience the highest growth rate in the market between 2025 and 2034. Industries such as food and beverage, chemicals, pharmaceuticals, pharmaceuticals, and oil and gas are generating increasing amounts of wastewater, requiring advanced treatment systems. Growing emphasis on environmental compliance, water recycling, and process efficiency is boosting demand for industrial solutions.

Treatment Objective Insights

Why Is Wastewater Treatment Segment Dominating In Water & Wastewater Treatment Market?

The wastewater treatment segment dominated the market in 2024. Rapid urbanization, industrial growth, and population expansion have led to increasing volumes of wastewater that quire efficient treatment before discharge. Governments and municipalities are implementing stricter regulations to ensure treated water meets safety and environmental standards. Advanced technologies, including biological treatment, membrane filtration, and chemical processes, are widely adopted to enhance treatment efficiency and reduce environmental impact. These developments have positioned wastewater treatment as the core objective driving the market.

The water reuse/recycling segment is projected to expand rapidly in the market in the coming years. Increasing water scarcity, environmental concerns, and reuse treated water. Implementation of advanced technologies such as membrane bioreactors, reverse osmosis, and advanced oxidation allows high quality water recovery for industrial, agricultural, and municipal applications. This shift reduces freshwater dependency while promoting circular water management. As a result, water reuse and recycling is emerging as one of the fastest growing objectives in the market.

Treatment Technology Insights

Why Are Biological Processes Segment Dominating the Water & Wastewater Treatment Market?

The biological process segment dominated the market in 2024. Biological treatment methods, including activated sludge, bio filters, and membrane bioreactors, are widely preferred for their efficiency in removing organic matter and nutrients from wastewater. The sustainability, cost-effectiveness, and adaptability of biological processes make them suitable for municipal and industrial applications alike. Governments and private operators are increasingly relying on these methods to meet environmental regulations while minimizing energy consumption. This widespread adoption has made biological processes a dominant technology in the water and wastewater treatment market.

The membrane processes segment is projected to grow with the highest rate in the market during the studied years. Membrane technologies, including ultrafiltration, nanofilteration, and reverse osmosis, are gaining popularity due to their ability to efficiently remove contaminants, pathogens, and micro pollutants. These processes are being increasingly deployed in industrial, municipal, and decentralized water treatment water are fuelling further adoption. Consequently, membrane processes are emerging as one of the fastest growing technologies in the market.

Product Insights

Why Are Pumps And Motors Segment Dominating In Water & Wastewater Treatment Market?

The pumps and motors segment dominated the market in 2024. These products are essential for the movement, distribution, and processing of water and wastewater across municipal and industrial facilities. Their reliability, efficiency, and adaptability make them indispensable components of treatment plants. Ongoing infrastructure upgrades and modernization projects further drive demand for advanced pumping and moto systems. As a result, pumps and motors maintain a central role in the market.

The membranes and modules segment is expected to grow at the fastest rate in the market from 2025 to 2034. These components are critical for modern treatment technologies such as reverse osmosis, ultrafiltration, and nanofiltration. Rising demand for water purification, industrial reuse, and advanced wastewater treatment drives their adoption. Continuous technological advancements and improved durability are further enhancing market growth.

Deployment Insights

Why Is Public/ Municipal Segment Dominating The Water & Wastewater Treatment Market?

The public/municipal segment dominated the market in 2024. Municipal authorities are investing in water and wastewater treatment facilities to provide safe drinking water and manage sewage efficiently in growing urban areas. Implementation of advanced technologies, compliance with environmental standards, and government initiatives drive this adoption. Large scale projects across cities are expanding treatment capacity and enhancing water quality management. This has solidified public/ municipal deployment as a dominant segment in the market.

The decentralized/on-site segment is projected to witness strong growth over the forecast period. These systems are ideal for remote communities, industrial sites, and small urban clusters where centralized facilities are not feasible. Decentralized solutions allow flexible treatment, reduced distribution losses, and efficient resource management. Rising interest in localized, sustainable water treatment solutions is driving this trend. Consequently, decentralized deployment is emerging as a one of the fastest growing approaches in the market.

Capacity Insights

Why Is Large Segment Dominating the Water & Wastewater Treatment Market?

The large segment dominated the market in 2024. Large scale treatment plants serve urban centres and industrial cones, handling high volumes of water and wastewater efficiently. These facilities benefit from economies of scale, advanced technology integration, and regulatory support. Growing urban populations and industrial activities reinforce the demand for large segment a dominant factor in the market.

The small segment is projected to expand rapidly in the market in the coming years. Small-capacity treatment plants are increasingly deployed in decentralized systems, rural areas, and small industries. They offer flexibility, lower installation costs, and the ability to serve localized water treatment needs efficiently. Technological innovations are improving performance and making small plants more viable. This positions the small segment as one of the fastest growing capacities in the market.

Regional Insights

Why Is Asia Pacific Dominating The Water & Wastewater Treatment Market?

Asia Pacific dominated the global water & wastewater treatment market in 2024, driven by rapid industrialization, urbanization, and stringent environmental regulations. Countries in the region are investing heavily in advanced treatment technologies to address water scarcity and pollution challenges. The adoption of membrane filtration, biological processes, and digital monitoring systems is on the rise. Government initiatives and public private partnerships are further accelerating infrastructure development. This combination of factors positions Asia Pacific as the dominant force in the water treatment sector.

India stands out as a significant contributor to the water and wastewater treatment market, with substantial investments in infrastructure and technology. The government’s focus on initiatives like the Jal Jeeven Mission and Swatch Bharat Abhiyan has led to widespread improvements in water accessibility and sanitation. Urban centres are adopting advanced treatment solutions, including reverse osmosis and decentralized systems, to meet growing demand. Private sector involvement and international collaborations are further enhancing the sector’s capabilities. India’s commitment to sustainable water management underscores its pivotal role in the global water treatment landscape.

Why Is the Middle East & Africa Growing Fast Treatment In Water & Wastewater Treatment Market?

The Middle East & Africa expects the fastest growth in the market during the forecast period due to increasing water scarcity and rapid industrial expansion. Governments are focusing on large scale desalination projects, advanced wastewater recycling, and sustainable water management initiatives to meet growing urban and industrial demand. The adoption of modern treatment technologies, including membrane processes and biological treatment, is gaining momentum across the region. Public private partnerships and foreign investments are accelerating infrastructure development, ensuring better access to clean water. These combined efforts are positioning the region for rapid market growth on the coming years.

Saudi Arabia is dominating the Middle East & Africa water treatment market with significant investments in desalination and wastewater recycling facilities. The government’s focus on achieving water security through innovative treatment solutions has driven the implementation of large scale projects across urban and industrial sectors. Advanced technologies, such as reverse osmosis and smart monitoring systems, are being increasingly adopted to optimize water use and ensure compliance with environmental regulations.

More Insights in Towards Chemical and Materials:

- Boiler Water Treatment Chemicals Market : The global boiler water treatment chemicals market size was reached at USD 5.52 billion in 2024 and is expected to be worth around USD 15.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.85% over the forecast period 2025 to 2034.

- Water Treatment Polymers Market : The global water treatment polymers market volume was valued at 8,323.10 kilotons in 2024 and is estimated to reach around 15,477.50 kilotons by 2034, exhibiting a compound annual growth rate (CAGR) of 6.40% during the forecast period 2025 to 2034.

- Sludge Treatment Chemicals Market : The global phosphate fertilizers market size accounted for USD 7.85 billion in 2024 and is predicted to increase from USD 8.30 billion in 2025 to approximately USD 13.65 billion by 2034, expanding at a CAGR of 6.55% from 2025 to 2034.

- Energy Dense Materials Market : The global energy dense materials market size was reached at USD 63.12 billion in 2024 and is expected to be worth around USD 211.44 billion by 2034, growing at a compound annual growth rate (CAGR) of 12.85% over the forecast period 2025 to 2034.

- Polymer Foam Market : The global polymer foam market size was approximately USD 160.43 billion in 2025 and is projected to reach around USD 273.58 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 6.11% between 2025 and 2034.

- Regenerative Agriculture Market : The global regenerative agriculture market size accounted for USD 12.95 billion in 2024 and is predicted to increase from USD 15.38 billion in 2025 to approximately USD 72.21 billion by 2034, expanding at a CAGR of 18.75% from 2025 to 2034.

- Flat Steel Market : The flat steel market size accounted for USD 687.55 billion in 2024 and is predicted to increase from USD 724.33 billion in 2025 to approximately USD 1,157.84 billion by 2034, expanding at a CAGR of 5.35% from 2025 to 2034.

- Nickel Market : The nickel market size is calculated at USD 41.88 billion in 2024, grew to USD 44.92 billion in 2025, and is projected to reach around USD 84.49 billion by 2034. The market is expanding at a CAGR of 7.27% between 2025 and 2034.

- Building Envelope Market : The global building envelope market size was valued at USD 117.48 billion in 2024, grew to USD 124.00 billion in 2025, and is expected to hit around USD 201.63 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.55% over the forecast period from 2025 to 2034.

- Biopolymers Market : The global biopolymers market size was valued at USD 19.85 billion in 2024, grew to USD 21.93 billion in 2025, and is expected to hit around USD 53.68 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.46% over the forecast period from 2025 to 2034.

Water & Wastewater Treatment Market Top Key Companies:

- Veolia

- SUEZ

- Xylem Inc.

- Danaher Corporation

- Evoqua Water Technologies

- Ecolab (Nalco Water)

- Pentair PLC

- Grundfos

- Kurita Water Industries

- IDE Technologies

- Doosan Heavy Industries & Construction

- Thermax Ltd.

- Mitsubishi Heavy Industries

- Fluence Corporation

- Aquatech International

- Ovivo Inc.

- Alfa Laval

- KSB SE & Co. KGaA

- Sulzer Ltd.

- Hach Company

Recent Developments

- In April 2025, Bengaluru based FluxGen introduced and AI and IoT powered water intelligence platform to optimize industrial water usage. It offers real time monitoring, predictive insights, and compliance support. Early deployments have shown reduced water withdrawal and consumption, and the company is expanding into the Middle East and Africa.

- In November 2024, Reliance Industries acquired a 21% stake in U.S. based Wavetech Helium, aligning with its strategy in low carbon solutions. Helium demand is rising in healthcare, aerospace, electronics, and AI sectors, supporting Reliance’s broader industrial ambitions.

Water & Wastewater Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Water & Wastewater Treatment Market

By End-User Industry

- Municipal utilities (potable & sewage)

- Industrial (process water & industrial effluent)

- Commercial & Institutional (hospitals, hotels, offices)

- Residential (building/community-level systems)

- Agricultural / Irrigation

By Treatment Objective

- Potable water treatment

- Wastewater treatment for discharge

- Water reuse/recycling (non-potable & indirect potable)

- Desalination (seawater & brackish)

- Sludge/biosolids treatment

By Treatment Technology / Method

- Physical separation (screening, sedimentation, clarification, DAF)

- Filtration (sand/media/cartridge)

- Membrane processes (MF / UF / NF / RO / FO / MD)

- Biological processes (activated sludge, MBR, SBR, biofilm)

- Chemical treatment (coagulation/flocculation, pH adjustment, precipitation)

- Disinfection (chlorination, UV, ozone)

- Ion exchange & adsorption (carbon, resins)

- Advanced oxidation processes (AOPs)

- Thermal processes (evaporation, crystallization, incineration for sludge)

- Electrochemical processes (electrocoagulation, electrooxidation)

By Product / Equipment

- Membranes & modules

- Pumps & motors

- Clarifiers & sedimentation tanks

- Biological reactors

- Filtration units

- Disinfection equipment

- Sludge dewatering & drying equipment

- Chemical dosing & storage systems

- Control & automation systems

- Desalination-specific units

By Deployment / Ownership Model

- Public / Municipal

- Private / Industrial captive

- Public-Private Partnerships (PPP) / BOT / BOOT

- Decentralized / On-site systems

By Capacity / Plant Size

- Small (< 1,000 m³/day)

- Medium (1,000–10,000 m³/day)

- Large (10,000–100,000 m³/day)

- Very large (>100,000 m³/day)

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5881

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.